Know your options when faced with a mesothelima diagnosis.

Michigan's Mesothelioma Attorneys Specializing in Asbestos Exposure Litigation.

Industries We Represent

Michigan Unions And Trades We Represent

Endorsed by Plumbers Local 98

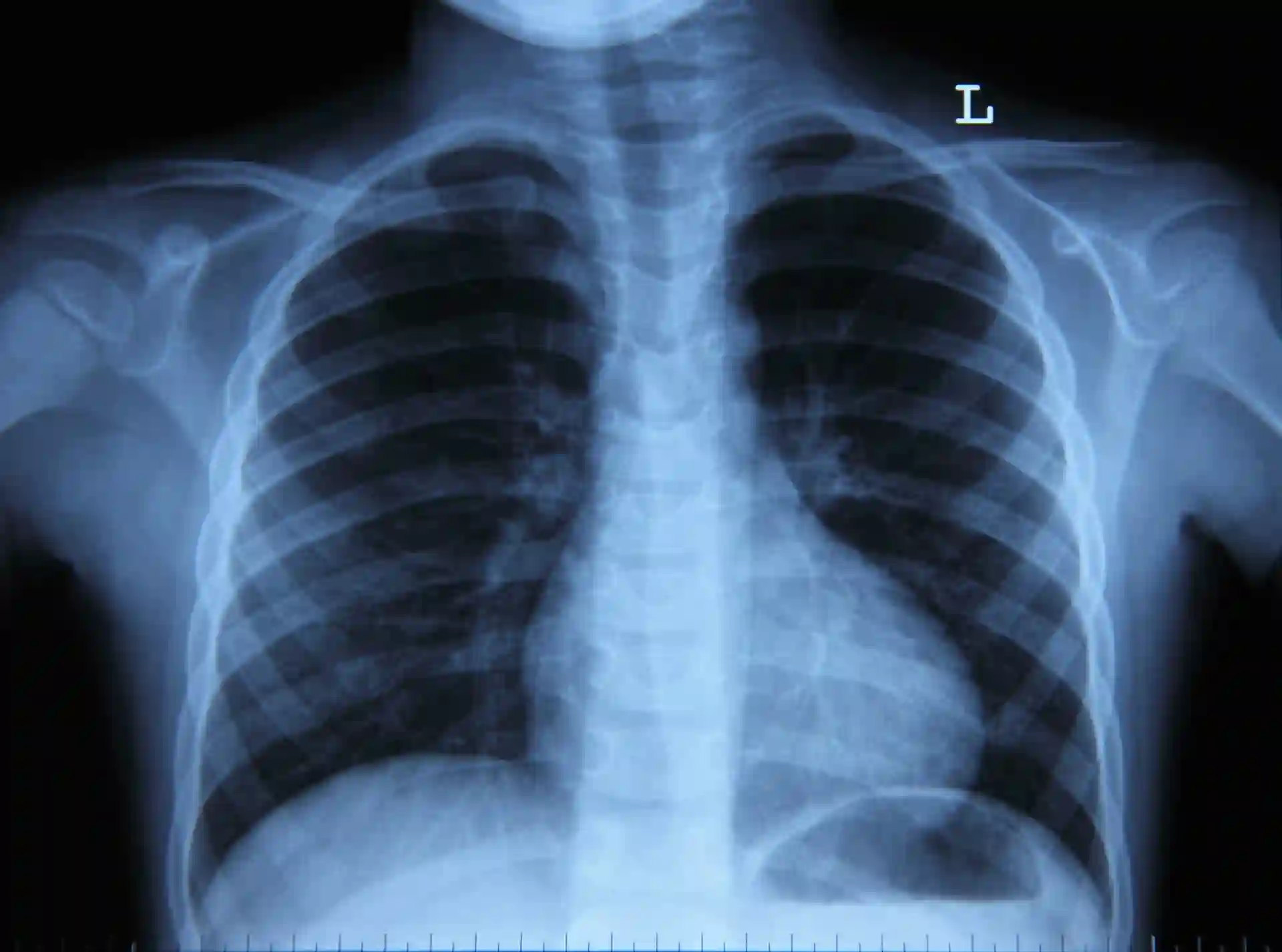

Could you be at risk for Mesothelioma?

According to the National Cancer Institute, everyone will be exposed to asbestos as low levels of the mineral are present throughout the environment. Since exposure can be minimal, most people won’t see a change in their health unless they are exposed on the job or through significant environmental contact.

Learn more about Mesothelioma & Lung Cancer with our Free Guide

If you or a loved one have been diagnosed with Mesothelioma or Lung Cancer, we’re here to help. Our comprehensive Michigan Mesothelioma and Lung Cancer Guide covers it all, including the warning signs of the disease, the professions that encounter it and asbestos-containing products in Michigan. Don't let asbestos-related diseases steal your peace of mind — claim your free guide today and learn about our Law Firm dedicated to helping you.

Michigan's First and Finest

Mesothelioma Attorney Specializing in Asbestos Exposure Litigation

5,000+

Michigan plaintiffs represented in asbestos-related cases

150+

Years combined experience

335

Michigan school districts represented against asbestos manufacturers

30

Billion dollars available in bankruptcy trusts for asbestos disease victims

Areas Of Practice & Expertise

150+ years of combined experience.

Don’t be fooled by lawyers that have no knowledge of asbestos-containing products in Michigan. Avoid Michigan firms that only broker cases and have no expertise handling Michigan asbestos litigation.

We have represented union members of every major Michigan building trade in asbestos disease including Railroad & Ship Yards, Auto, Chemical, Utility, and Steel Plants.